UPDATE: 10/23/2021; 2:45:02 AM

We have watched this coming supply chain collapse building, and building for years now. There is no way to avoid it. The only variable is the timing. If you are watching then you are aware that everything is closing in on us at the same time. This is just one more piece of the RESET puzzle. I have a hard time convincing people that there is nothing GREAT about the RESET other than the size of it. It will be global and therefore inescapable. It will be SOON. The world WILL NEVER go back to what we once knew as NORMAL. NEVER/EVER!! It will be a world that is not user friendly for average people like you and me. IF we live to experience it.

I am not trying to scare you. Just stating the facts. There is no reason to fear, if you belong to GOD. There is no room for fear. Fear and Deception are their greatest weapons. DO NOT GIVE THE DEVIL ANY GROUND! TRUST GOD, READ THE WORD. PRAY and Share the TRUTH with others.

TAGS: International Air Transport Association (IATA), the International Road Transport Union (IRU) and the International Transport Workers’ Federation (ITF), Supply Chain, Cargo Ships, Major US Ports, Drifting at Sea, Global Infrastructure, Trucker Shortage, Pandemic, Inflation, Unemployment, Government Intervention, Lockdowns, Travel Restrictions, Manpower, Unloading Goods, consumer demands, infrastructure bill pending, trade logistics, railyards and trucking routes, Baby Boom, Generation, traffic jam analogy, mythology surrounding inflation, No Quick Fix, Economic Collapse, widespread shortages, fast food outlets, meat, World Health Organization, United Nations General Assembly, the International Chamber of Shipping (ICS), fiscal stimulus , Money Supply, BitCoin, currency collapse, demographics, infrastructure, maritime-road-aviation industries/

spacer

TheBubbaNews: US Long Beach California Port Backed Up… [13.10.2021] (bitchute.com)

Note: Food shortage my ass… This is systematic planned by the Satanist…

Read the US comment under the original video….

Here is a Bird’s eye view on the Long Beach California Port Backed Up and the shipping containers not moving. A record 500,000 shipping containers sit at LA & Long Beach ports! Prices for goods are expected to rise dramatically as demand rises & supply lessons.

1,001 views Oct 13, 2021

TheBubbaNews

6.62K subscribers

https://youtu.be/t8P-DiEKwDI

https://www.youtube.com/channel/UC3kqO0nPUX3EHJmiRVdD7bA

spacer

UPDATE: 10/23/2021; 2:45:02 AM

October 2, 2021

UPDATE: 10/19/2021; 9:35:19 AM

Streamed live on Oct 16, 2021

spacer

UPDATE: 10/16/2021; 1:20:38 PM

spacer

Update: 10/15/2021; 8:57:49 PM

UPDATE: 10/11/2021; 10:26:35 AM

It’s Christmas in October or so the retailers are saying. If one wants to celebrate the traditional gift exchanges that come with the Christmas season, one better complete their shopping this month, or their holiday celebration will be limited to gathering near the family Christmas tree, provided that the Green New Deal hasn’t taken over the grid.

As bad as the Christmas retail season appears to be, it pales in comparison to what is happening to the food supply, both domestically and internationally.

The U.S. Department of Labor reports that in the past 12 months since July 2020, the consumer price index has increased 5.4%, including a 2.6% in food at home prices. Meat, poultry, fish and eggs cost 5.9% more than they did last July, and meals prepared outside of the home are 4.6% more expensive. The immediate predictions are that the shortages that we are now witnessing will pale in comparison to what is coming. No amount of “shrinkflation” will mitigate the coming disaster related to the food supply.

The Predatory United Nations Is Licking Their Chops

The United Nations is salivating as the seriousness of the emerging calamity as they see an opportunity to send their “peacekeeping troops to every country under the guise of humanitarianism when in fact this will end up being putting most of the nations on the planet in a state of de facto martial law! Out of chaos comes order, the New World Order!

Some may doubt the accuracy of this prognostication. However, these same same “Doubting Thomas’ may be well-advised that the UN will soon be coming to a neighborhood near you as I am receiving multiple reports of UN (supposed medical) vehicles arriving Down Under. One can safely bet that many of these “humanitarian troops” will include Communist Chinese soldiers. All of this is being done in a nation that locked down its nation based on 9 alleged deaths of Covid-19. Of course this nation, several years ago, gave up their guns. Watch Australia, it is coming here and this won’t a case of next year’s trend. It is happening now…

-

Relevent United Nations Report On Food Vulnerability

- GENERAL ASSEMBLY

THE UNITED NATIONS THIRTY-FIRST SPECIAL SESSION, 2ND MEETING (RESUMED) (December 4, 2020-AM, PM & NIGHT)

Amid Threat of Catastrophic Global Famine, COVID-19 Response Must Prioritize Food Security, Humanitarian Needs, Experts Tell General Assembly

…Likewise, David Beasley, Executive Director of the World Food Programme (WFP), warned of alarming global hunger and food insecurity, with the number of people “marching towards starvation” spiking from 135 million to 270 million as the pandemic unfolded. He stressed that 2021 will be catastrophic. “Famine is literally on the horizon and we are talking about the next few months,” he said. Noting how the WFP stepped in to deliver aid when the global airline industry shut down at the start of the pandemic, he warned anew that 2021 risks becoming the worst humanitarian crisis year since the founding of the United Nations, “and we will have to step up”…

CBS News took an interest in the UN’s prognostication of a famine of “Biblical” proportions..

…The World Food Program, which works to fight hunger worldwide, serves nearly 100 million people a day, including 30 million who depend on the organization to stay alive, according to Beasley. He said that every night, 821 million people go to bed hungry.

Some 135 million people are acutely food-insecure and facing crisis levels of hunger or worse, according to a report published this week called the 2020 Global Report on Food Crisis. Now, the coronavirus could push an additional 130 million people “to the brink of starvation”…

CAN’T YOU JUST BUY STOREABLE FOOD?

To some degree that is true, but that window of opportunity to sidestep the emerging crisis is closing. Look at what is happening to some of the major players in the industry:

To all our interested and valued customers,

We want you to know that OUR PRODUCTION AND FULFILLMENT CONTINUES. While we are current, we ask that you understand we still experience occasional product lapses and shipping delays. We are proud that you have chosen NuManna as your source for storable food…….especially proud that you make us your choice in these uncertain times.

_________________________________________________________________________________

From Mountain House Regarding Delivery Issues to Customers

PLEASE EXPECT DELAYS IN TRANSIT DUE TO NATIONWIDE CARRIER DISRUPTIONS

________________________________________________________________________________

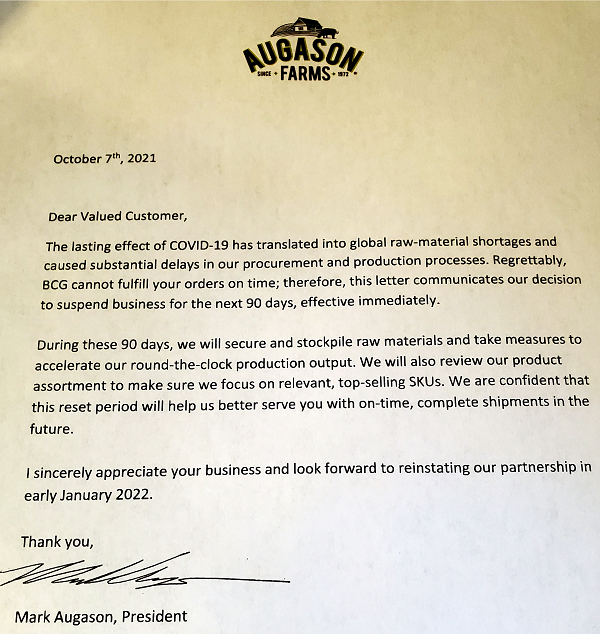

The food company Augason Farms just issued a letter to its suppliers, declaring it will “suspend business for the next 90 days, effective immediately,” stating, “[Augason Farms] cannot fulfill your orders on time.”

The company is having critical supply chain failures combined with extraordinary demand. This is happening across multiple supply chains.

My Patriot Supply still has storeable food and the prices have not yet hyper-inflated. However, it is unlikely that any company is going to escape the ravages of the damage done by the Biden Administration for much longer!

Temporary Relief Suggestions From Oklahoma State University

Cindy Clampet, an Oklahoma State University Extension specialist in human development and family science, offers the following money-saving tips for grocery shopping.

- Comparison shop for frequently purchased items. Consider coupons and other stores.

- Avoid purchasing groceries at convenience stores or gas stations.

- Focus less on name brands. Off-brand items may be cheaper.

- Buying in bulk may not save money. Conduct unit pricing of desired items to determine potential savings.

- Stock up on items used most often if they are on sale.

- Be intentional with meal planning. Survey refrigerator and cabinets to determine what needs to be consumed first before shopping.

- Plan for leftovers.

- At work, bring lunch, snacks and drinks from home instead of eating out or snacking from a vending machine.

- Avoid eating out. If on a budget, reserve dining out for special occasions.

- Use rice and beans as nutritious extenders for meals — shop for 100% whole wheat items.

- Avoid impulse buys on snack items such as chips, crackers, cookies and soda pop.

There is one missing item from Clampet’s list, a way to defend your supplies when all hell breaks loose!

The Invevitable Food Holocaust

As good as the above-mentioned suggestions may be, they are only stop-gap measures. Biden partially sealed America’s fate by making us dependent on unreliavle foreigh oil imports and this created a break in the supply chain, among other factors. Further, the Democrats stimulus payments (ie the Fabian Socialist Universal Basic Income) contributed to workers staying off of the job long after the lockdowns were rescinded in most areas. The labor shortage, artificially created, is contributing to the ships that cannot offload. And even if they could offload, one unnamed source from the trucking industry, and a food supplier told me that by the end of October, the nation will experience an acute shortage of 60,000-70,000 truckers. When this happens the “just-in-time” deliveries will slow down and eventually stop and the shelves will be empty and predatory violence will begin in earnest.

Soon, every day in America, and across the planet, will be like the final day at the stores before the arrival of Hurricane Harvey in which it took one day to empty out the store supplies in Houston. When this happens, where will you turn? Do you really think that this administration is capable of meeting the food needs of an entire natiom? After this administration left over a thousand Americans behind enemy lines in Afghanistan, do you even trust that they will try and meet your needs? Ask yourself a question America: When have you ever seen communists engage in humanitarian efforts? Make no mistake about it, we just went through a Bolshevik Communist takeover of America following the stolen election of 2020. No administration could be this incompetent. We are witnessing the UN/CHICOM-inspired takedown of America and the rest of the planet.

You have the shortest window in which to gather as much life-saving supplies as you can. We are probably looking at the latest October surprise….who needs FEMA camps when one controls the food? I talked to one person who said he was maxing out his credit cards because who’s going to send the collection industry in a society that is in absolute chaos?

Finally, if one doubts the gravity of this situation, I would suggest reading a history book about Stalin and Ukraine’s Holodomor. Yes, this is deliberate!

Food, water, guns, ammo, natural medicine and tools are your barest of essentials. How much do you need? In recent interviews of two experts on the CSS, both Robert Griswold and Daisy Luther stated “2 years worth and seeds.” The old saying “be quick, or be dead” comes to mind.

Doesn’t the Book of Revelations say something about plagues and famines…and this is just the beginning. Are we in the tribulation, nobody can say for sure. Certainly, nobody can say we are not!

spacer

Oct 8, 2021

Spacer

Lyn Alden: This ENTIRE US Supply Chain Is About To Collapse And ACCELERATE The Inflation Crisis MORE

Lyn Alden: This ENTIRE US Supply Chain Is About To Collapse And ACCELERATE The Inflation Crisis MORE

Lyn Alden gives her foresight on what she believes will happen to the us supply chain in the coming 6 months… And it doesn’t look good

📺AIR DATE: 9th September 2021

CREDITS: https://www.youtube.com/channel/UCLTdCY-fNXc1GqzIuflK-OQ

#lynalden #lynaldeneconomy #lynaldeneconomiccrisis #lynaldengold #lyninflation #twodollarsinvesting

spacer

Beyond the Southern border, another looming crisis for the Biden administration is the backlogged container ships anchored off the coasts of California and New York that now have to wait up to 4 weeks to unload their shipments.

“Dozens of cargo ships anchored off the coasts of Los Angeles and New York face shocking wait times of up to four weeks and railyards and trucking routes are hopelessly clogged due to the lack of manpower to unload goods,” reported the Daily Mail.

LOS ANGELES, CALIFORNIA – SEPTEMBER 20: In an aerial view, container ships are anchored by the ports of Long Beach and Los Angeles as they wait to offload on September 20, 2021 near Los Angeles, California. Amid a record-high demand for imported goods and a shortage of shipping containers and truckers, the twin ports are currently seeing unprecedented congestion. On September 17, there were a record total of 147 ships, 95 of which were container ships, in the twin ports, which move about 40 percent of all cargo containers entering the U.S. (Photo by Mario Tama/Getty Images)

Due to the pandemic, American consumer demands have never been higher, with people spending less money on travel and entertainment and more on toys, clothing, electronics, and a whole range of goods. However, due to lack of manpower in conjunction with intense coronavirus restrictions, American ports have simply been unable to unload the shipments in a timely manner.

LOS ANGELES, CALIFORNIA – SEPTEMBER 20: In an aerial view, container ships (Top L) are anchored by the ports of Long Beach and Los Angeles as they wait to offload on September 20, 2021 near Los Angeles, California. (Photo by Mario Tama/Getty Images)

“Global infrastructure was not designed to handle goods at such a rate,” one expert on the situation told the Daily Mail. “Supply chains are the artery who feeds our entire ecosystem. The government needs to intervene to stop this crisis immediately, or face increased inflation and unemployment, and economic breakdown – or face an end to global trade.’

Footage obtained by DailyMail.com shows the scale of the problem on the seas with more than a dozen cargo ships and oil tankers anchored outside New York’s harbor, waiting to unload their goods.

Ports in Los Angeles and Long Beach – two of the most popular shipping destinations in the US – are currently housing vessels that have been left anchored for four weeks.

The ports saw as many as 73 vessels waiting to unload earlier in September, and 66 container ships this week, according to Marine Exchange of Southern California data cited by The Wall Street Journal.

According to CBS Los Angeles, up to 500,000 shipping containers are floating off the Southern California coast, with truck drivers waiting in line for hours to transport their scheduled shipments.

“I’ve got friends right now that are in line… from nine o’clock in the morning and they can’t pull the load yet,” truck driver Walter Martinez told CBS. “The people inside, they get paid by the hour, but not the drivers.”

A fully loaded cargo ship heads into New York Harbor in New York City. (GETTY IMAGES NORTH AMERICA/AFP/File SPENCER PLATT)

Truck driver Oscar Ovalle confirmed that he waited from 8 p.m to 3 a.m. in the morning, with one crane lifting containers for 60 trucks.

“They kicked me out because they leave at three o’clock,” said Ovalle. “There’s one crane for 60 trucks and it’s ridiculous! They have two other cranes sitting.”

Gene Seroka, the Executive Director of the Port of Los Angeles, has called upon the Federal Reserve System to aid in the crisis.

“Over the last 10 years, the federal government and Congress have out-invested West Coast ports at a rate 11 to one. That’s got to change, and with an infrastructure bill pending vote in Congress this week, we need all eyes on Los Angeles,” said Seroka. “This is what 10 years of under-investment looks like, and we need to move forward.”

According to the Daily Mail, “Consumer experts have warned Americans to begin doing their Christmas shopping now, to ensure goods arrive on time, and to ensure there’s time to try and find an alternative if a desired gift is one of the products that is currently scarce.”

spacer

The Common Sense Show is dedicated to peaceful, non-violent social and political change.

Workers who maintain supply chains issue bone-chilling warning every American needs to hear

by Kipp Jones

Global experts in trade logistics, who know more about getting things from point A to point B than President Joe Biden does about ice cream, are asking authorities to simply let them do their jobs unrestrained after almost two years of coronavirus red tape.

In an open letter released this week, they spelled out the stakes of continued delays caused by pandemic protocols. They asked the UN, the World Health Organization and anyone else listening to intervene to prevent a “global transport systems collapse.”

“Since the outset of the COVID-19 pandemic, the maritime, road and aviation industries have called loudly and clearly on governments to ensure the free movement of transport workers and to end travel bans and other restrictions that have had an enormously detrimental impact on their wellbeing and safety,” the letter said.

“Transport workers keep the world running and are vital for the free movement of products, including vaccines and PPE, but have been continually failed by governments and taken for granted by their officials,” the experts added, noting that they are responsible for a combined $20 trillion in annual world trade.

“We ask heads of government to urgently take the leadership that is required to bring an end to the fragmented travel rules and restrictions that have severely impacted the global supply chain and put at risk the health and wellbeing of our international transport workforce.”

According to the leaders of the shipping industry, nobody is listening, and a global disaster could be the result.

“We are witnessing unprecedented disruptions and global delays and shortages on essential goods including electronics, food, fuel and medical supplies. Consumer demand is rising and the delays look set to worsen ahead of Christmas and continue into 2022.”

The letter also referred to ships stuck out at sea waiting to be unloaded. We’ve seen some of this in the U.S., as dozens of container ships remain anchored near the Port of Long Beach in the Los Angeles area:

More than 70 container ships are stacked up outside of California’s Long Beach port waiting to unload. Talk about a supply chain problem! Take a look.pic.twitter.com/VMfmYEAU4B

— Steve Hanke (@steve_hanke) September 28, 2021

Port of Long Beach executive director: "The situation is in a crisis mode… I would advise the consumers to start your Christmas shopping early."

The Port of Long Beach is moving to extend operations to 24/7 to help alleviate a backlog of ships.@MariaBartiromo @FoxBusiness pic.twitter.com/frLMldPVPT

— Mornings with Maria (@MorningsMaria) September 27, 2021

Cargo ships are gathered outside of Los Angeles and Long Beach ports, due to shortages of truck drivers and full warehouses.

The backlog could spark shipping delays and shortages around the holidays in toys, gifts, and more. pic.twitter.com/iRSeUUEF5P

— ABC 10News San Diego (@10News) September 23, 2021

Daily Mail US Daily Mail US@DailyMail

< Dozens of ships are forced to anchor off coast of New York as they wait to dock in the country’s second-largest port

dailymail.co.uk

Dozens of ships off coast of New York wait to dock in port

Some two dozen container ships appear to be stuck at sea miles off the south shore of Long Island, as more than 60 vessels wait to dock at two of the country’s largest ports on the West Coast.

|

Charles Kenny

@charlesjkenny

“Without a “significant change around the status of the border”, New Zealand’s wine industry will continue to have a seriously depleted workforce, an industry leader says.”

stuff.co.nz

Labour shortage leaves wine industry facing uncomfortable truth

Attracting and retaining workers has always been an issue in the wine industry, and Covid has only made it worse, say industry leaders.

|

According to international shipping workers, these backlogs should be taken as a sign that something needs to change — and quickly.

The experts warned that things could soon get worse, as many workers are expected to simply quit.

“It is of great concern that we are also seeing shortages of workers and expect more to leave our industries as a result of the poor treatment they have faced during the pandemic, putting the supply chain under greater threat,” their letter warned.

The workers concluded by calling on world leaders to take “meaningful and swift action to resolve this crisis now.”

While ships stack up in California and New York, Biden and Democrats have spent this week squabbling over their agenda, which includes spending trillions of dollars on “infrastructure” — meaning roads and bridges, presumably.

If the trade situation is as dire as the experts are saying it is, there might not be anyone to navigate those roads and bridges with the goods we rely on if something isn’t done fast.

Surely, those in command know what is happening. The only question: Why is nothing being done about it?

Read more at: WesternJournal.com

spacer

I’m taking a break from discussing data modeling this issue to focus instead on potentially more contentious issues, specifically supply chains, work from home, and the phase transition of society to a new form.

I do want to preface this with the observation that I am not an economist, though I am something of a system theorist. The arguments presented here may anger some people, but my goal is not to attack political shibboleths, but rather to give people an alternative perspective about how the economy (and inflation) actually work.

Supply Chain Disruptions and Dominos

With that said, after thirty-five years of watching how trends play out, one thing I’ve discovered is that the true impact of any event, any disruption, usually does not manifest immediately, nor does it occur in a vacuum. The current computer chip shortage has its origins in a fire in Japan earlier this year that shut down a major production plant there, the pandemic reducing available workforces while forcing more reliance upon shipping, a just-in-time management strategy that business managers used to try to save money by reducing redundancy in the supply, and automobile executives canceling chip orders in 2020 because they thought that demand was going to collapse.

What’s notable here is that this has caused a dramatic increase in the price of electronics (which increasingly is everything that’s not actually put in your mouth) which in turn is affecting everything else. The same thing is happening for food and gasoline, pushing inflation up dramatically after a couple of decades where inflation seldom reared its head. Monetarists have been pushing hard on the thesis that this has been due to rampant fiscal stimulus (that is, money going into the pockets of ordinary people rather than multibillionaires) despite very little evidence that this is actually happening. These same people have been downplaying the impacts of supply chain disruption, in part because the latter implies poor business decisions were made (reflecting badly on those people) and in part, because supply chains are complex.

Supply Chains As Systems

A supply chain is not, as its name may imply, linear.

A car, for instance, is made up of thousands of different parts, many of which are components that have subordinate parts. The supply chain, from the perspective of the finished car, is more like a tree or a river delta. For instance, fuel injectors have built-in sensors that regulate fuel flow. In order to be able to put a fuel injector into a car, that fuel injector will need to be constructed at a previous time. No chips, no fuel injector. No fuel injector, no car. If the plant that produces the chips goes offline because of a disaster such as a fire, this creates a disruption. If an outbreak of Covid causes the fuel injector manufacturer to work at 75% capacity because its workers are sick, this too creates a disruption. If the ships that bring the fuel injector to the auto plant are forced to wait at docks because there are too few workers to empty them, this too creates a disruption.

When this happens repeatedly all throughout the supply chain, the disruptions cascade. The market is signaling demand and the suppliers are producing to meet that demand, but the supply is getting snarled in traffic.

Actually, the traffic jam analogy is a good one, because both are systemic effects involving transportation. A disruption, in this case, could be a fender-bender – traffic slows as other drivers move around the two drivers involved, the police show up and get the cars off the road until a tow truck can come. Once the distraction is gone, traffic picks up again. These occur frequently, but their impact for the most part is barely noticeable – people may get home a few minutes later than they would have otherwise.

However, occasionally you get situations such as one that occurred in Tennessee several years ago, where heavy fog caused a seventy car pile-up. This ended up taking more than a day to resolve, because there were only a limited number of tow trucks and police units, because in some cases the police and tow trucks couldn’t get through as all lanes were completely blocked, and because local hospitals could absorb only so many casualties. At this point, the situation has become systemic, with interdependencies developing that make resolving the problem far more complicated. In effect, the system has dead-locked.

Labor Supply Chains

We are in the midst of a similar situation now, especially with regard to employers and workers. When COVID-19 first hit the US back in Spring 2020, many companies reacted first by furloughing workers, then laying them off in massive amounts, causing the unemployment rate to spike to nearly 20%. As the first wave of the pandemic peaked then receded nearly a year later, companies began rehiring, in anticipation of returning to the way things had been. We are arguably going through the second wave now with the delta variant causing more than a little anxiety with companies that may have restaffed too soon (which adds yet another disruption into the mix).

While it may not seem obvious, labor is still a supply-chain issue. In general, when you hire a person, you are hiring for a specific skill-set (including soft skills) to do a particular set of tasks. To get a person to a certain degree of proficiency in a skill, that same person starts out getting training, acquires self-confidence and facility, and increasingly also learns how to manage others doing the same thing. The goal for an employer is to hire and retain a given employee with sufficient skills and talents at the lowest possible price point for that employer. The goal of an employee is to maximize their salary and benefits while increasing their own value in the marketplace.

When unemployment soared to 20% (i.e., one person in five was unemployed), what had been a local problem became a systemic one. It meant that a whole lot of labor was suddenly available that hadn’t been, which would, on the surface, favor employers. However, two factors changed the equation fairly dramatically. The first was that during the first wave of the pandemic, many people made the realization that they could work as or more productively from home than they could from the office due to the state of technology. The second factor was more subtle: once you realize that you didn’t have to work in an office, it opens up where you can work (and whom you work with) significantly.

In addition to this, quite a number of people who were laid off were getting within a few years of retirement (or were at the age where you can retire and get benefits) and realized that they simply didn’t want to get back into the saddle again. In 1955, the peak of the Baby Boom Generation was born, which meant that in 2020 they turned 65. Given the size of this generation at its peak, this took a large swath of people aged 63 and older out of the workforce, and we are now facing a declining older workforce from now until the mid-2030s, made up primarily of the most experienced people within companies.

A second issue emerged with the pandemic and the strong anti-immigration stance of the Trump administration – outsourcing opportunities declined in 2020, forcing many companies to start sourcing workers more locally.

Finally, wage inequality had been rising throughout the twenty-first century, primarily as wages failed to rise with inflation even as investment income increased dramatically. At the same time, the ability to create a business mediated by the Internet has become more and more feasible over time, to the extent that younger people have built up secondary streams of income over the Internet that were beginning to mature when the pandemic hit.

The upshot of all of this has been that companies went back into hiring expecting to hire back people at as low a rate as possible, only to discover that the combined need for specialization, greater mobility due to working virtually, the decline in the availability of older, highly skilled specialists and the hollowing out of the mid-tier of workers to outsourcing meant that wage expectations had risen dramatically (or put another way, wage inflation was also increasing).

This too is putting pressure on supply chains. You have fewer people working farms, fewer people driving trucks or manning ships, fewer people interested in working retail even as malls reel from a year of reduced traffic compared to online sources, fewer restaurant workers.

In general, local disruptions tend to have little impact on the status quo. but systemic disruptions almost invariably do because their time frame is so much longer. As we head into the Delta Variant Winter, it now looks like we won’t be through the pandemic until Summer 2022, assuming that other variants (such as Mu) don’t repeat the cycle next year.

Supply chains are networks. The strength of networks is that they adapt under stress over time, strengthening certain connections and patterns while routing around others. However, the longer this process takes place, the more that the networks end up favoring those new patterns over the old ones, especially when the changes due to the stress had already become trends before the stressors took hold.

This has huge ramifications. The workforce is becoming decentralized, and, at least in the arena of knowledge work, more global. Part of the reason that income inequality exists has been the fact that it has generally been far easier for US companies to outsource work (and take advantage of wage differentials) than it has been for US workers to work for non-US companies. However, that is now changing, as remote work begins to dominate, and, in many respects, the danger that represents to US companies is fairly profound: foreign companies are increasingly in a position to poach US talent, and many of those foreign have deep pockets.

Supply Chain Disruptions and Inflation

There is a great deal of mythology surrounding inflation, and as inflation heats up, that mythology is being spoken once again by the movers and shakers. There is, for instance, a persistent belief that stimulus spending causes inflation. There is, ironically, almost no evidence for this. The last major era of inflation came in the mid 1970s through the early 1980s, with another period starting shortly after the Second World War and going almost into 1960.

It’s worth looking at each of these eras. In the late 1940s and early 1950s, GIs had returned to the United States after the war, the economy was still geared up to produce weapons, artillery and military-issued goods. The process of converting those factories from wartime to peacetime production took quite some time, and at the same time, the GIs were going to college on the GI bill, then marrying their high school sweethearts, buying houses in the suburbs and brand new cars, and pumping out kids. In other words, demand was outstripping supply – for new houses, new cars, new clothes, new kitchens, new nurseries and playground equipment and on and on.

It also took a while to sort out labor for all the new factories being created or converted. The supply-chains were needing to be built, and until they were, there was too much demand for too few goods, causing the prices of those goods to shoot up in value. Because labor was tight, the same thing was happening with salaries. So the first period of inflation was due to supply-chain disruptions, and they eventually eased as production caught up with demand.

The second period of inflation had to do with a decision made originally in 1944, at Bretton Woods, New Hampshire, when 44 countries gathered to hammer out a post-war agreement on economic recovery (Germany had not yet declared defeat, but it was becoming obvious that it would happen by that point). One of the major stipulations was the agreement that oil, in heavy demand at this point, would have a fixed price per ounce of gold. Since gold was not in fact all that useful a mechanism for currency, the US further declared that they would fix US dollars to gold as well, so that if you wanted to buy oil, you would have to do so in dollars. How do you buy dollars? You sell gold, or you buy property, stock or bonds. As the US was the last man standing, most of the rest of the countries involved in the summit reluctantly let them do it.

During the fifties, this was great for the US, rapidly filling their coffers and making America the world’s wealthiest nation. However, the population was expanding in the US faster than it ever had, and this meant that there wasn’t enough available paper money to allow for population growth or to make loans. John F. Kennedy raised the USD/GLD rate, Johnson raised it again. Finally, Nixon tried to do it again, but De Gaul of France retaliated by demanding that US redeem the gold that France had sold them as part of the accords. Nixon responded by closing the gold window, which ended Bretton Woods and left much of the world holding American dollars.

As this was going on, the US hit peak oil in 1971, when the country was forced to start buying imported oil even as everyone else realized that they were holding fiat currency that was not backed by much of anything. OPEC, which had been around since the 1950s, began to nationalize their oil production, in many cases, seizing control of existing (US) oil companies, and the price of oil, temporarily unmoored, rose dramatically to about four times it’s previous value (about $13 a barrel, compared to about $2.50 a barrel in 1970. This had the effect of causing an oil shock, resulting in the 1971 recession and significant dislocation, and because the US was now consuming more oil than it was producing, commodity prices soared even as wages and economic activity collapsed, resulting in weak hiring.

This was again a supply-chain problem, though having to do with passed costs rather than significant supply-chain disruption. The cost of producing goods became prohibitive, and forced a great number of companies out of business quickly. disrupting supply even more. Add on to this the fact that Boomers, which hit their birth peak in 1955, were hitting the age that they would ordinarily start families (in their late twenties and early thirties, which is the period of peak demand). The history of inflation during this period was actually somewhat anomalous, in that the oil shock had largely faded by 1975 and inflation was on its way down, then it began expanding again into Ronald Reagan’s term (partially through secondary oil shocks due to the fall of the Shah of Iran

Paul Volcker, as Fed Chairman, raised interest rates dramatically under Reagan, but not at his behest (in fact, Volcker managed to avoid being fired because Fed members cannot be fired during their term, but he lost considerable sway from that time on). This did cause a recession that slowed the recovering economic activity sufficiently that the impact of the Boomers on spending had passed.

Is Inflation Really Caused By Money Supply?

Monetarists, including Milton Friedman, had long argued that it was “reckless” deficit spending that causes inflation, but if you replace the words “fiscal stimulus” with “lower and middle class tax cuts” (which is what such stimulus really is), it’s worth noting that there’s surprisingly little correlation between tax policy in general and inflation. Tax cuts that favor the rich tend to get reflected in the stock market (and income inequality) but have comparatively little impact on the economy, as the Trump Tax cuts in 2017 demonstrated clearly, at a time when the economy was actually at near full capacity. Obama’s tax cuts (sorry, “stimulus”) were fairly limited, and I think it is arguable whether the tax cuts should have been larger, but the result of that was a long, slow recovery. It likely did increase the velocity of money in the economy by enough to keep the recession from worsening, but not enough to significantly increase economic activity.

I don’t know whether or not Friedman’s thesis about the link between monetary supply and inflation is correct, but I do believe that supply chain disruptions play a much bigger role than they are credited for in causing inflation, as does demographics. When a population is growing, to maintain the same level of economic activity you have to increase the available money supply, which means that a certain degree of inflation is actually desirable. When Friedman was writing his thesis, the population was increasing dramatically, and that created supply-chain shocks. Today, the population is increasingly far more slowly (and should actually peak by 2050, incorporating immigration. Without immigration, the US, like much of the OECD, would actually be shrinking).

My assertion, then, is simple, if disturbing – as population growth cools, most inflation will be caused by supply-chain shocks rather than monetarist policy, while there will in fact be an underlying deflationary pressure as the population plateaus then begins shrinking again. In the short term, the pandemic and not fiscal policy is causing inflation, and once the pandemic is brought back under control, inflation itself should fade away as supply-chain disruptions are mitigated. Monetary policy can help or hurt those most vulnerable to economic disruptions, but so long as there are competing pressures, the long term effects of monetary policy will largely cancel out.

There are two caveats and a final observation to this. The first is that I believe the potential for supply-chain disruptions will grow over time. The US (and the whole world) had the hottest summer on record in 2021, in what has been several decades filled with records to the upside with comparatively few to the downside. These cause localized disruptions, but as with the multi-car pile-up example given earlier, enough localized disruptions can create systemic disruptions. This means spikes of inflation battling an overall trend towards deflation.

The second caveat is that as such disruptions are becoming more frequent (and there is evidence that this is happening) then inflation may not be the worst part of it. The economy of the United States in particular has been predicated upon population growth leading economic growth through most of its history. As that paradigm fades, several assumptions about how the economy itself works will need to be revisited. For instance, does no one think it odd that interest rates have been effectively zero (and sometimes negative) for more than twenty years, with no apparent untowards effects?

The final observation is that the likelihood of the United States suffering a Weimar-like hyperinflation event is, in my mind, non-existent, except perhaps in the face of political dissolution (and maybe not even then). A hyper-inflation event is a currency collapse, and usually occurs only once a government becomes perceived by a majority of the population as being defunct but there is no solution to recover it. The strength of the United States ironically is that should dissolution happen, what would likely take place instead is devolution – the country would become four or five smaller nations, each with reasonably healthy economic systems. Hyper-inflation in that scenario is not a cause but a symptom of a collapsing state.

spacer

21.2K18:01 To Watch This Video On BitCHUTE CLICK THE TITLE LINK BELOW:

21.2K18:01 To Watch This Video On BitCHUTE CLICK THE TITLE LINK BELOW:The [CB] / [DS] are following their agenda, as they continue down the path the people can see very clearly it is not in their best interest and they are destroying the economy. Since the vaccine passport in NYC , business is down 40%-60%. Trump says if the pass the the D’s plan we will be moving into socialism. Texas poised to be the next crypto powerhouse.

Most of artwork that are included with these videos have been created by X22 Report and they are used as a representation of the subject matter. The representative artwork included with these videos shall not be construed as the actual events that are taking place.

Fair Use Notice: This video contains some copyrighted material whose use has not been authorized by the copyright owners. We believe that this not-for-profit, educational, and/or criticism or commentary use on the Web constitutes a fair use of the copyrighted material (as provided for in section 107 of the US Copyright Law. If you wish to use this copyrighted material for purposes that go beyond fair use, you must obtain permission from the copyright owner. Fair Use notwithstanding we will immediately comply with any copyright owner who wants their material removed or modified, wants us to link to their web site, or wants us to add their photo.

The X22 Report is “one man’s opinion”. Anything that is said on the report is either opinion, criticism, information or commentary, If making any type of investment or legal decision it would be wise to contact or consult a professional before making that decision.

Use the information found in these videos as a starting point for conducting your own research and conduct your own due diligence before making any significant investing decisions.

A “System Collapse” Due To The Failure Of Global Supply Chains

, If CNN starts sounding like The Economic Collapse Blog, what does that mean? Unfortunately, the truth about what is in our immediate future is becoming apparent to everyone. Global supply chains are in a state of complete and utter chaos, and this is driving up prices and causing widespread shortages all over the country.

Over the past couple of weeks, I have written five articles with either “shortage” or “shortages” in the title, and some have accused me of being a little alarmist. If that is the case, then CNN is being alarmist too, because one of their top stories today openly warned of a “global transport system collapse”…

In an open letter Wednesday to heads of state attending the United Nations General Assembly, the International Chamber of Shipping (ICS) and other industry groups warned of a “global transport system collapse” if governments do not restore freedom of movement to transport workers and give them priority to receive vaccines recognized by the World Health Organization.

For decades, we have all been able to take our extremely complex supply chains for granted. Things have always been where they need to be when they needed to be there, and many of us just assumed that it would always be that way.

But now organizations that represent 65 million transport workers around the globe are openly warning that “global supply chains are beginning to buckle”…

“Global supply chains are beginning to buckle as two years’ worth of strain on transport workers take their toll,” the groups wrote. The letter has also been signed by the International Air Transport Association (IATA), the International Road Transport Union (IRU) and the International Transport Workers’ Federation (ITF). Together they represent 65 million transport workers globally.

“All transport sectors are also seeing a shortage of workers, and expect more to leave as a result of the poor treatment millions have faced during the pandemic, putting the supply chain under greater threat,” it added.

Things are particularly bad at our ports. Right now, there is a backlog of approximately 500,000 shipping containers waiting on ships off the west coast waiting to be unloaded…

As an estimated 500,000 containers are sitting on cargo ships off the Southern California coast, many are wondering how to handle the backlog.

Needless to say, we have never seen anything like this before.

But what most Americans don’t realize is that the backlog off the coast of China is even worse…

There are over 60 container ships full of import cargo stuck offshore of Los Angeles and Long Beach, but there are more than double that — 154 as of Friday — waiting to load export cargo off Shanghai and Ningbo in China, according to eeSea, a company that analyzes carrier schedules.

The number of container ships anchored off Shanghai and Ningbo has surged over recent weeks. There are now 242 container ships waiting for berths countrywide. Whether it’s due to heavy export volumes, Typhoon Chanthu or COVID, rising congestion in China is yet another wild card for the trans-Pacific trade.

If you are waiting for something to come in from overseas, you may be waiting for a very long time.

Because of all the chaos, we are being warned that this could be a holiday season like no other…

Retailers are sounding the alarm on the upcoming holiday shopping season due to serious supply chain issues that are slowing shipments of manufactured goods around the world.

Chaos theory in it’s simplest form says if a butterfly flaps its wings in China, it means rain in Central Park. Well, that applies not just to weather, but supply chains as well, and in the Bay Area, it will impact everything from computer parts for your car to the gifts and toys on your holiday shopping list.

If there is something that you really want to get your hands on, you might want to order it now, because it may not be available later.

In addition to shortages, supply chain issues are also pushing prices significantly higher.

For example, we just learned that the price of bacon has risen almost 28 percent over the past year…

The average price for that slab of bacon to accompany the Sunday morning spread has jumped nearly 28% during the past 12 months, inflation-adjusted Consumer Price Index data show.

The supply chain issues and inflationary pressures that have become all-too common in these pandemic times certainly have played theirs roles in the pork price hikes, alongside a slew of industry-specific influence.

A lot of people may be forced to stop eating bacon as a result of soaring prices, and from a health perspective that is not a bad thing.

And the price of bacon is going to continue to go higher, because U.S. hog herds are shrinking at a brisk pace…

US hog herds experienced the most significant monthly drop in two decades, according to new data from the USDA. The reason behind the drop is because farmers decreased hog-herd development over the last year due to labor disruptions at slaughterhouses plus high animal feed.

USDA data showed the US hog herd was 3.9% lower in August than a year ago. It was the largest monthly drop since 1999 after analysts only expected a decline of about 1.7%, according to Bloomberg.

Many of you already don’t eat bacon, and so what I just shared may not affect you, but what about a shortage of potatoes?

Incredibly, it is being reported that some fast food outlets are now running out of French Fries. The following comes from Matt Stoller…

My favorite story is quintessentially American, and un-American, at the same time. It’s from a Florida realtor who was in a hurry and stopped at a Burger King for lunch. He saw a sign, “Sorry. No French Fries with any order. We have no potatoes.” At first he thought he was imagining things. What kind of fast food place runs out of fries? Is this, he wondered, a sign of things to come?

It’s a good question. Fast food exists in a land of plenty, of surplus, of mass produced food with a reliable infrastructure of trucks, trains, farms, and distributors. Shortages of everyday goods conflicts not only with most of our lived experiences, but also with our very conception of who we are. There’s a name for this framework, and it’s called affluence.

I really like how Stoller made that last point.

So many of us think that since we are the most prosperous nation on the entire planet that long-term shortages could never happen to us.

But they are happening.

And if you think that what we are experiencing now is bad, just wait until we get a few more years down the road.

From the very top to the very bottom, our entire economic system is being shaken.

If you are expecting our national leaders to come in with some sort of a quick fix to this crisis, you are going to be waiting a really, really long time.

The blind are leading the blind, and the months ahead are going to be very challenging.

FOR MORE INFORMATION ON THE SUPPLY CHAIN COLLAPSE PLEASE VISIT THE LINK BELOW:

|

|

|